Managing finances while dealing with bipolar disorder can feel like balancing on a tightrope. The unpredictability of mood swings can lead to impulsive spending during manic phases and poor financial decisions during depressive episodes. But don’t worry—there’s hope. With the right strategies and a proactive approach, financial stability is within reach, helping alleviate some of the stress that comes with this condition.

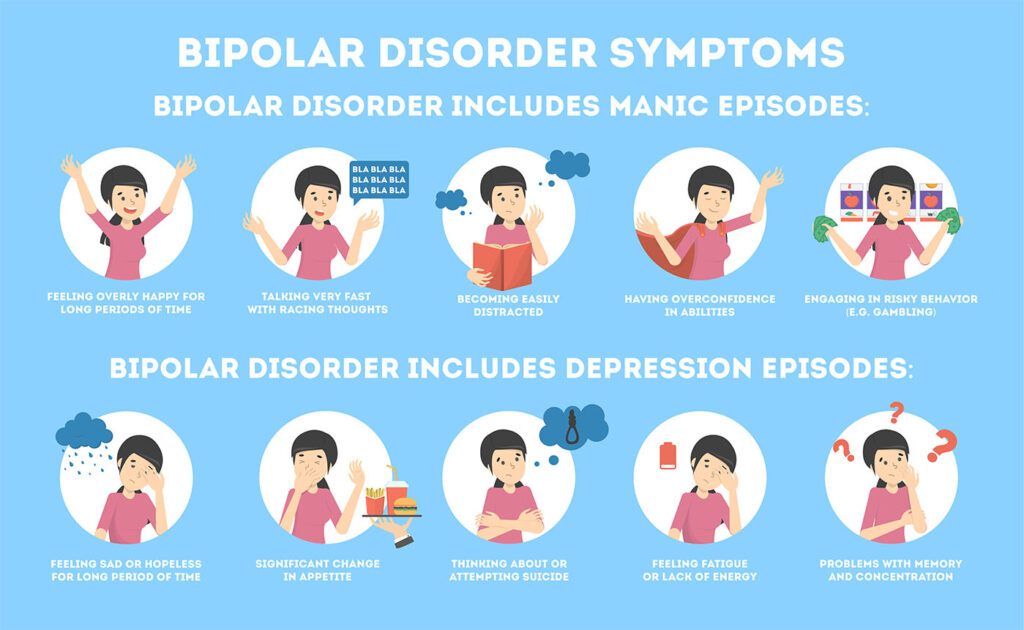

Bipolar disorder is a mental health condition characterised by extreme mood swings, including emotional highs (mania or hypomania) and lows (depression). These fluctuations can significantly impact a person’s ability to manage their finances effectively. The reality is that during manic episodes, individuals may experience impulsive behaviour, resulting in unplanned and extravagant spending. In contrast, depressive episodes might lead to neglecting financial responsibilities, such as paying bills on time.

Understanding and addressing the financial aspects of living with bipolar disorder is essential for ensuring long-term well-being. This article explores the financial challenges faced by individuals with bipolar disorder and provides practical strategies to manage these challenges. From budgeting and setting realistic financial goals to exploring employment options and building an emergency fund, we’ll cover it all. By the end of this article, you’ll be equipped with actionable insights and tips to navigate the financial complexities associated with bipolar disorder.

Understanding Bipolar Disorder and Its Financial Impact

What is Bipolar Disorder?

Bipolar disorder is a mental illness marked by significant shifts in mood, energy, and activity levels. It is classified into several types, primarily bipolar I, bipolar II, and cyclothymic disorder. Bipolar I disorder involves severe manic episodes lasting at least seven days or requiring hospitalisation. Bipolar II disorder is characterised by a pattern of depressive and hypomanic episodes, but without the full-blown manic episodes seen in bipolar I. Cyclothymic disorder involves chronic mood swings that are less severe than those of bipolar I or II.

These mood swings can lead to significant disruptions in daily life, including financial management. During manic phases, individuals might feel invincible and make impulsive decisions, such as extravagant spending or risky investments. Conversely, during depressive phases, lack of energy and motivation can result in neglecting financial obligations.

Financial Challenges Faced by Individuals with Bipolar Disorder

Living with bipolar disorder often brings unique financial challenges. Employment and income stability can be significantly affected, as mood swings might result in frequent job changes or difficulties maintaining consistent work performance. Individuals with bipolar disorder may face challenges such as taking time off work due to their condition, which can impact their income and career progression.

Moreover, impulsivity during manic episodes can lead to financial mismanagement, while depressive episodes might cause individuals to ignore bills, leading to increased debt and financial stress. These patterns can create a cycle of financial instability, further exacerbating the stress associated with managing bipolar disorder.

Importance of Financial Planning for Bipolar Disorder

Creating a Stable Financial Environment

Establishing financial stability is crucial for individuals with bipolar disorder, as it provides a sense of security and reduces stress. A stable financial environment can positively impact mental health, helping individuals feel more in control of their lives. By implementing effective financial planning strategies, individuals can create a safety net that mitigates the impact of mood swings on their financial well-being.

Setting Realistic Financial Goals

Setting realistic financial goals is an essential step in achieving financial stability. By aligning financial objectives with mental health needs, individuals can create a roadmap that supports their overall well-being. It’s crucial to set achievable goals that account for potential challenges related to bipolar disorder, such as unexpected medical expenses or periods of unemployment.

Budgeting for Stability

Developing a Personal Budget

A well-structured budget is a powerful tool for managing finances with bipolar disorder. Begin by assessing your monthly income and expenses, categorising them into essentials (e.g., housing, utilities, groceries) and discretionary spending (e.g., entertainment, dining out). Utilise budgeting tools and apps to track your spending habits and identify areas where you can cut back.

One effective approach is the 50/30/20 rule, which allocates 50% of your income to essentials, 30% to discretionary spending, and 20% to savings and debt repayment. This method helps prioritise necessary expenses while allowing room for enjoyment and future savings.

Managing Expenses and Reducing Debt

Managing expenses and reducing debt are essential components of maintaining financial stability. Consider reviewing your monthly expenses to identify non-essential items that can be trimmed or eliminated. This might involve reducing dining out, entertainment subscriptions, or shopping expenditures. Redirect the saved money towards paying off high-interest debts, such as credit cards or personal loans.

To tackle debt effectively, consider adopting the debt snowball or avalanche method. The debt snowball method involves paying off the smallest debts first to gain momentum, while the avalanche method prioritises paying off debts with the highest interest rates. Both approaches offer a structured way to address debt, providing a sense of accomplishment and motivation.

Income Management and Employment Strategies

Understanding Employment Rights

It’s essential for individuals with bipolar disorder to be aware of their employment rights and available accommodations. In the UK, the Equality Act 2010 protects individuals with disabilities, including bipolar disorder, from discrimination in the workplace. This means that employers are required to make reasonable adjustments to accommodate the needs of employees with bipolar disorder.

Open communication with employers is crucial for ensuring a supportive work environment. If you feel comfortable, consider discussing your condition with your employer and exploring potential accommodations, such as flexible work hours or remote work options.

Exploring Flexible Work Options

Flexible work arrangements can significantly benefit individuals with bipolar disorder by providing a more adaptable schedule that aligns with their needs. Remote work, part-time positions, or freelance opportunities can offer greater flexibility and allow individuals to manage their condition more effectively.

When exploring employment options, consider seeking out companies known for their inclusive and supportive work environments. Research employers that prioritise mental health and offer workplace accommodations for individuals with bipolar disorder.

Building an Emergency Fund

Importance of an Emergency Fund

An emergency fund serves as a financial safety net, providing a buffer during periods of financial instability. For individuals with bipolar disorder, having an emergency fund is essential to cover unexpected expenses, such as medical bills or periods of unemployment. This fund can alleviate the stress associated with financial uncertainty and prevent further disruptions to mental health.

Strategies for Saving Consistently

Consistency is key when building an emergency fund. Start by setting a realistic savings goal, such as three to six months’ worth of living expenses. Automate your savings by setting up regular transfers from your checking account to a dedicated savings account. Even small, regular contributions can accumulate over time, providing peace of mind and financial security.

Consider finding additional ways to save money, such as cutting back on non-essential spending or taking advantage of discounts and promotions. Prioritise building your emergency fund until you reach your target amount, then continue to contribute as your financial situation allows.

Utilising Financial Assistance Programs

Government and Non-Profit Support

Numerous government and non-profit programs are available to support individuals with bipolar disorder. In the UK, individuals may be eligible for benefits such as Personal Independence Payment (PIP) or Employment and Support Allowance (ESA), which provide financial assistance to those with disabilities.

Additionally, various non-profit organisations offer support services, financial assistance, and resources for individuals with mental health conditions. Research available programs and apply for those that align with your needs to access valuable support.

Financial Counselling and Support Groups

Financial counselling and support groups can provide valuable guidance and encouragement for managing finances with bipolar disorder. Financial counsellors can help develop personalised financial plans and strategies tailored to your unique circumstances. Additionally, support groups offer a sense of community and shared experiences, providing emotional support and practical advice from individuals facing similar challenges.

Managing Healthcare Costs

Understanding Health Insurance Options

Health insurance is a critical component of managing healthcare costs associated with bipolar disorder. In the UK, the National Health Service (NHS) provides healthcare services, but private health insurance can offer additional coverage and shorter wait times for certain treatments.

When selecting a health insurance plan, consider your specific needs, such as coverage for psychiatric care, medications, and therapy. Review different plans and compare coverage options, premiums, and out-of-pocket costs to choose a plan that best suits your healthcare requirements.

Reducing Prescription and Treatment Costs

Managing the cost of medications and treatments is essential for individuals with bipolar disorder. Explore options for reducing prescription costs, such as using generic medications or utilising discount programs offered by pharmacies. Additionally, consider discussing treatment options with your healthcare provider to identify cost-effective alternatives or therapies.

Research available support programs that offer financial assistance for medications and treatments, such as patient assistance programs or charitable organisations. These resources can help alleviate the financial burden associated with ongoing medical care.

Maintaining Financial Well-being

Regular Financial Check-ups

Regular financial check-ups are essential for maintaining financial well-being and ensuring that your financial strategies remain effective. Set aside time each month to review your budget, track your expenses, and assess your progress towards financial goals. Use financial tracking tools and apps to streamline this process and gain insights into your financial health.

During these check-ups, evaluate whether any adjustments are needed to accommodate changes in your circumstances, such as fluctuations in income or unexpected expenses. Regularly reviewing your financial situation can help you stay on track and make informed decisions.

Coping with Financial Stress

Financial stress can exacerbate the symptoms of bipolar disorder, making it crucial to develop effective coping strategies. Practise stress-reduction techniques such as mindfulness, meditation, or deep breathing exercises to manage stress and maintain emotional well-being.

If financial stress becomes overwhelming, consider seeking support from a mental health professional or financial adviser. They can provide guidance, support, and strategies to help you navigate challenging financial situations and maintain a sense of control.

Conclusion

Managing finances with bipolar disorder requires a proactive approach, patience, and the willingness to seek support when needed. By implementing effective financial strategies, individuals can create a stable financial environment that supports their mental health and overall well-being. Remember that you are not alone—numerous resources, support programs, and professionals are available to help you navigate the financial challenges associated with bipolar disorder. Take the first step towards financial empowerment today and embrace the journey towards a brighter and more secure future.

FAQs?

What financial resources are available for people with bipolar disorder?

Individuals with bipolar disorder may be eligible for government benefits such as Personal Independence Payment (PIP) or Employment and Support Allowance (ESA). Non-profit organisations also offer financial assistance and support services for individuals with mental health conditions.

How can I communicate my needs to my employer?

It’s important to have open and honest communication with your employer about your needs. Consider discussing your condition and exploring potential accommodations, such as flexible work hours or remote work options, to create a supportive work environment.

What are the best budgeting apps for managing finances with bipolar disorder?

Popular budgeting apps include Mint, YNAB (You Need a Budget), and PocketGuard. These apps help track expenses, create budgets, and provide insights into spending habits, making it easier to manage finances effectively.

How can I reduce the cost of my medications?

To reduce medication costs, consider using generic medications or discount programs offered by pharmacies. Additionally, explore patient assistance programs or charitable organisations that provide financial assistance for medications.

What steps can I take to build an emergency fund quickly?

Start by setting a realistic savings goal and automating regular contributions to a dedicated savings account. Cut back on non-essential spending and redirect those savings towards building your emergency fund.

Are there specific financial advisers who specialise in mental health?

Yes, some financial advisers specialise in working with individuals with mental health conditions. They can provide personalised financial planning and strategies tailored to your unique circumstances.

How can I find support groups for financial management?

Look for local mental health organisations or online communities that offer support groups for individuals with bipolar disorder. These groups provide a sense of community, shared experiences, and practical advice for managing finances.